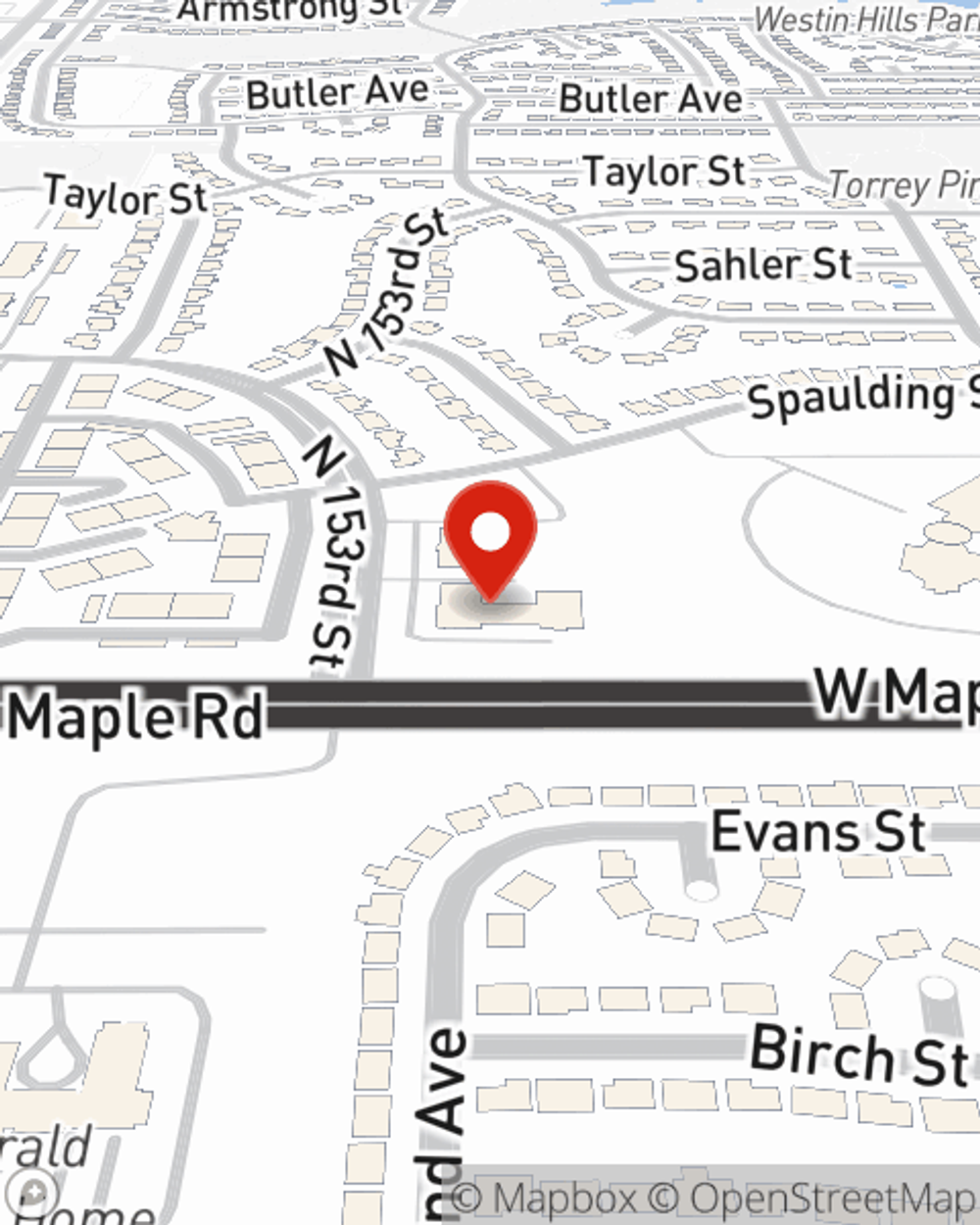

Homeowners Insurance in and around Omaha

A good neighbor helps you insure your home with State Farm.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

No one knows what tomorrow will bring. That’s why it makes good sense to plan for the unexpected with a State Farm homeowners policy. Home insurance covers more than your home. It protects both your home and your valuable possessions. If your home is affected by a tornado or falling trees, you may have damage to some of your possessions in addition to damage to the actual house. If you don't have enough coverage, you may struggle to replace all of the things you lost. Some of your valuables can be covered if they are lost or damaged outside of your home, like if your bicycle is stolen from work or your car is stolen with your computer inside it.

A good neighbor helps you insure your home with State Farm.

Apply for homeowners insurance with State Farm

Safeguard Your Greatest Asset

Preparing for life's troubles is made easy with State Farm. Here you can personalize your policy or submit a claim with the help of agent Kyle Iske. Kyle Iske will make sure you get the considerate, excellent care that you and your home needs.

As your good neighbor, State Farm agent Kyle Iske is happy to help you with creating your homeowners insurance plan. Get in touch today!

Have More Questions About Homeowners Insurance?

Call Kyle at (402) 572-1118 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.